We are proud of our history and heritage which is rooted as far back as the nineteenth century. Take a look at how far we have come since our inception, back in 1896. Start scrolling to explore.

After a call to invest in a proposed bank – the Calcutta City Banking Corporation, it opens for business on the morning of November 16, 1863 at 1/1 Mission Row, Calcutta.

The banks name is changed to National Bank of India. A new branch is opened in Bombay and a proposal sent to the directors to open a banking agency in London.

Process to turn the bank to a Sterling company commences. Some pioneers wanted a strictly Calcutta bank. Others wanted it to be an international institution.

Zanzibar -which has close trading links with India- and Pemba Islands become British protectorates. All revenues are administered by British officers.

After success in Pakistan, Burma, Ceylon and Aden, National Bank of India opens a new branch in India.

A branch of National Bank of India is opened in Mombasa owing to the thriving trade and The Imperial British East Africa Company opening new trading posts in the interior.

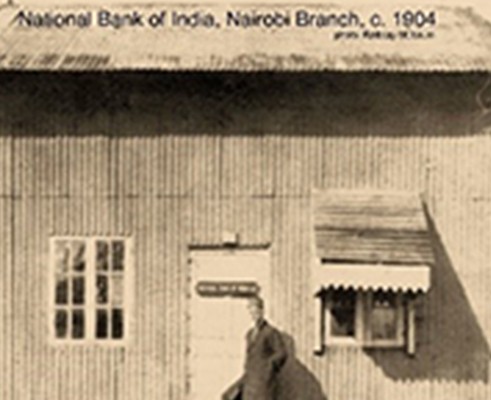

The bank opens a branch in Nairobi in a small tin shack with an increase in trade activity, such as the opening of Indian bazaar.

The bank gets into a profitable agreement with the Uganda Railway to become its sole banker while the railway gets guaranteed rates of interest on its provident fund monies.

The bank announces that the merger with Grindlays Bank scheduled for January 1, 1958, to form National Overseas and Grindlays Bank Ltd.

New branches are opened in Nairobi at Cargen House and in Karatina, replacing the temporary branch.

The bank opens more branches in Nairobi and upcountry in preparation for a new set of customers; Africans.

The bank opens a new branch in Ukwala Siaya and appoints H.E. Odhiambo as the first manager.

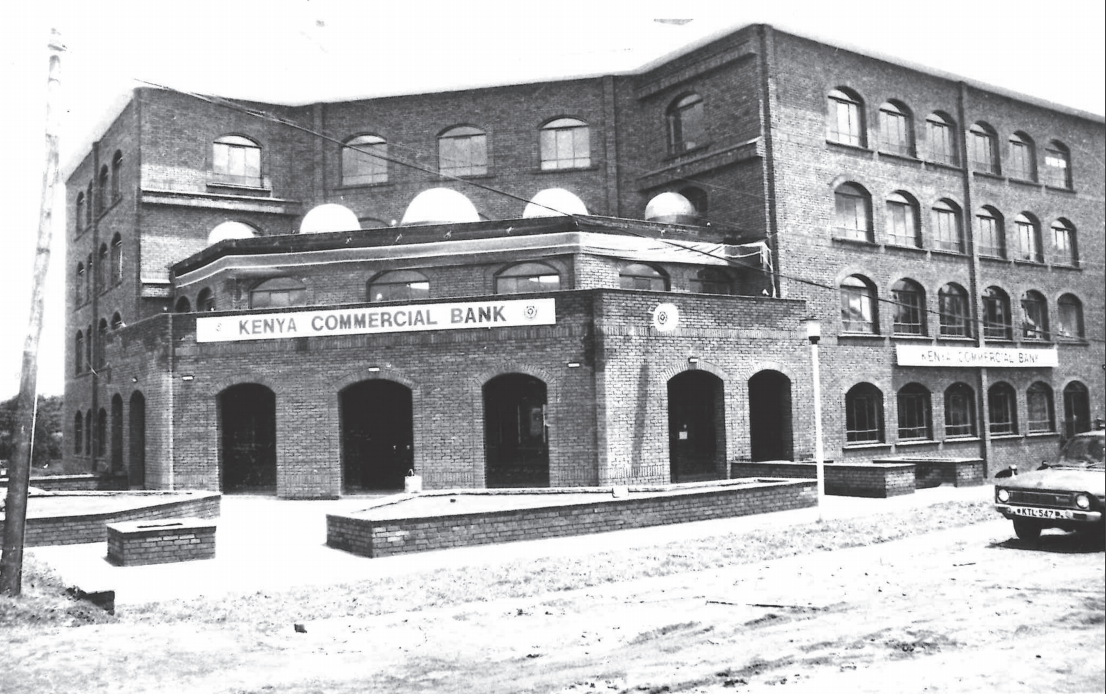

In July the government signs deal to become a 60% shareholder, giving it a new name, Kenya Commercial Bank, with the motto ‘Being closer to the people’.

President Kenyatta appoints former PS in the Ministry of Finance, John Michuki, as the chairman of the KCB board. The first general manager is P. B. Noble, the former Kenya manager of National and Grindlays Bank Ltd.

Savings and Loan Kenya Limited becomes a KCB subsidiary after it acquires all its shares, formerly owned by the Pearl Assurance Company.

KCB buys Kipande House, which had been put up in 1910 and gazette as a national monument, on condition that it makes no alterations.

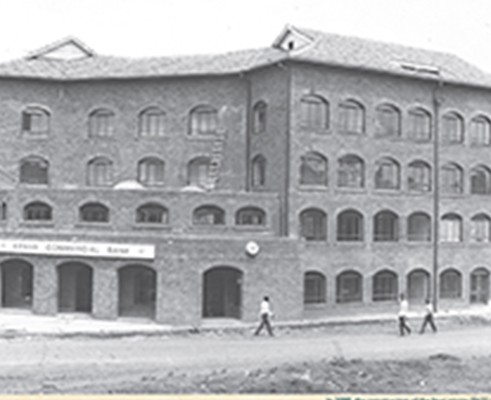

The bank opens a new headquarters and the country’s economy is thriving, recording a surplus of Sh2.2 billion after payments

KCB opens a new headquarters. The building today houses the Kenya National Archives.

The bank holds its first management conference on banking in Eldoret town, attracting more than 80 banking officers.

The bank launches a sports complex in Ruaraka, Nairobi. The bank also opens a new sub-branch in Sagana.

The bank opens a special services branch at Harambee Plaza and launches guaranteed cheques aimed at current account customers.

The bank offers an IPO. The bank also starts developing the New Runda Estate with the Staff Pension Fund and offers houses for sale.

The bank sees a 41.5% increase in pre-tax profits amounting to Sh375 million and contributes Sh260 million in taxes and dividends to the exchequer while deposits reach Sh13.9 billion.

The bank successfully launches the internationally accepted KCB VISA Card and the locally circulating KCB VISA Card.

The bank incorporates automated teller machines (ATMs) to reduce congestion in banking halls and sets up a team to work on internet banking and e-commerce.

KCB Chairman Peter Nyakiamo retires and is succeeded by Benjamin Kipkulei, a former diplomat who also served as chairman of the Kenya Revenue Authority.

In April 2003, days ahead of the year’s AGM, the chairman of the bank, Benjamin Kipkulei announced his resignation. Kipkulei was replaced by Susan Mudhune.

Gareth George is let go and replaced with Terry Davidson after he initiated an aggressive asset disposal programme that led him to sell Kencom House to the banks pension fund for Sh 1 billion.

With this renewed confidence, KCB in August 2005entered into a partnership with Western Union that allowed the bank to offer the money transfer service in all its branches.

KCB opens a new branch in Southern Sudan, the world’s newest nation.

Terry Davidson retires and Martin Oduor-Otieno becomes his successor.

KCB completed its Eastern African Regional presence with the opening of the KCB Bank Burundi and doubled its share price in the bourse surpassing the USD 1 Billion capital ratio and an impressive growth of 11% in its books.

KCB Bank received an international credit rating from Moody’s and S&P rating agencies. B1 and B+ respectively and at par with the Kenya sovereign rating. Launch of KCB M-PESA, a mobile based account , offered exclusively to M-PESA customers. 5M accounts were opened during the year transacting over KES 259B. Launch of Representative office in Ethiopia

KCB Launches sh50 billion 2jiajiri programme for youth employment.

KCB Group Plc was registered as a non-operating holding company to oversee all KCB regional units including KCB Bank Kenya, Tanzania, South Sudan, Uganda, Rwanda, Burundi and Ethiopia. It also owns KCB Insurance Agency, KCB Capital, KCB Foundation and all associate companies.

KCB Completes NBK Takeover.

KCB Group PLC completed the acquisition of Banque Populaire du Rwanda Plc (BPR) from Atlas Mara Mauritius Limited and Arise B.V.

KCB Tanzania KCB assets hit Sh1 trillion, graduates to tier-one status.

KCB Group Receive Approval To Merge Rwanda Operations.

Kenya Commercial Bank (KCB) Group has announced the appointment of Paul Russo as its chief executive officer, effective Wednesday 25 May.

KCB acquires DR Congo bank in expansion drive.

KCB lends Sh5bn in first big green loan financing.

KCB Group picks Annastacia Kimtai as the managing director of KCB Kenya.